Smaller Batteries, Smarter Charging: How India Can Electrify Bus Fleets Capital-Light

India’s bus electrification success will depend not just on deploying e-buses, but on treating routes, batteries, chargers, and the grid as one integrated, software-optimized system to cut costs, reduce import dependence, and strengthen energy security.

India’s bus electrification drive is moving from ambition to action. The government’s PM eBus Sewa program alone targets 10,000 e-buses across 100+ cities, sparking a wave of tenders, depot upgrades, and charging projects nationwide.

But as scale ramps up, a critical question emerges – can we electrify quickly without locking ourselves into costly battery imports, heavy capex, and grid bottlenecks?

The answer is yes, if we treat operations, vehicles, and charging as a single integrated system rather than a procurement checklist.

The Systems Lens: Routes → Batteries → Chargers → Grid

Electrifying buses isn’t just about swapping diesel tanks for kilowatt-hours. Energy use depends on route length, layovers, traffic, gradients, temperature, and passenger peaks.

When those realities are modeled alongside grid capacity, tariff windows, and charger dispatch, operators can right-size battery packs, charging infrastructure, and power demand—all at once.

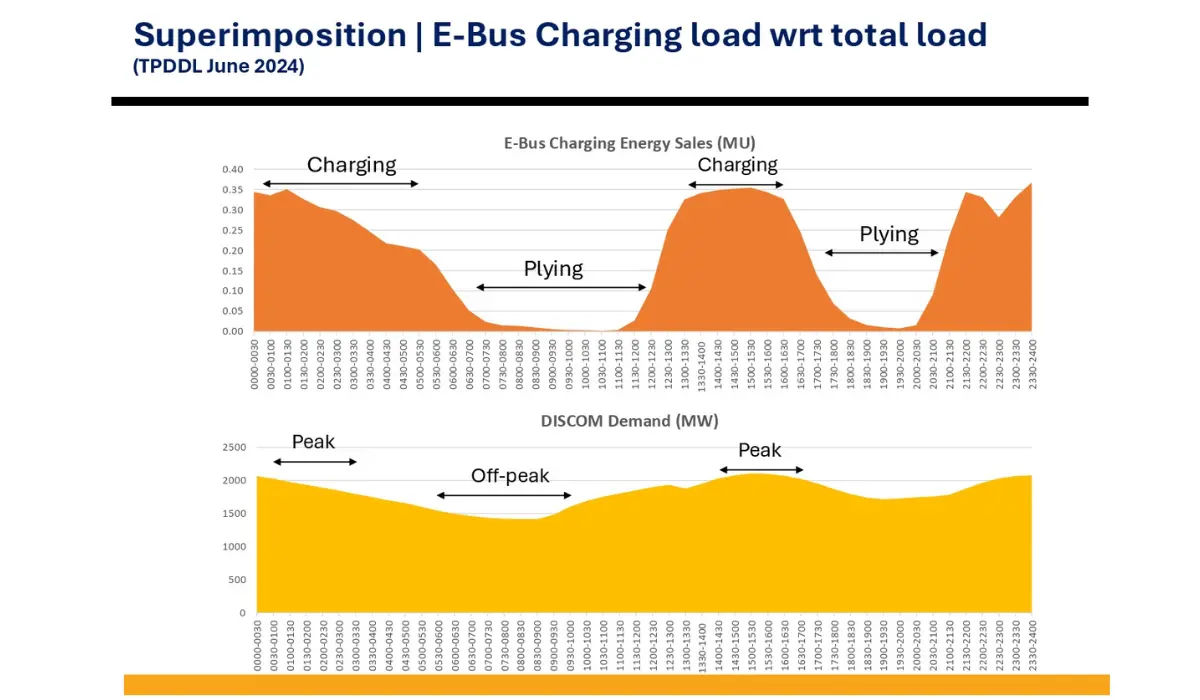

Evidence from Indian pilots shows that while discoms’ concerns over peak loads are real, managed charging and time-of-day (ToD) tariffs can flatten demand curves and avoid costly feeder upgrades. The right data-driven design lowers both capex and operational strain.

ICCT Research: Situational Analysis of Bus-Based Public Transport Supply in Delhi

Opportunity Charging vs. “Big Battery, Depot-Only”

The global lesson, and India is proving it, is that distributed opportunity charging beats “large-battery, depot-only” for many duty cycles.

- Hybrid Charging: Combining overnight depot charging with targeted mid-route or terminal top-ups, allows buses to run with smaller batteries while meeting service blocks.

- Case Studies: In Patna, strategically placed opportunity chargers reshaped the economics of availability and charger utilization. UITP’s work in Karnataka highlights how terminals, not oversized batteries, extend daily range.

- System Effects: Surveys show that simultaneous midday in-depot charging can stress feeders more than on-route top-ups, making distributed, scheduled opportunity charging the smarter grid play.

The Geopolitical Stakes: Batteries Are the New Oil

Here’s the reality: India still imports most of its lithium-ion cells, and cells make up 75–80% of a battery’s cost. Meanwhile, China controls the majority of global cell production and critical mineral refining. This concentration creates strategic vulnerabilities as India’s e-bus pipeline scales.

Every reduction in onboard battery size achieved through smarter charging and scheduling isn’t just an engineering tweak – it’s a hedge against import dependence and price shocks that compound across thousands of vehicles.

India’s Production-Linked Incentive (PLI) program for Advanced Chemistry Cells (ACC) is a step in the right direction, but gigafactories take years. In the near term, the fastest lever is to reduce watt-hours per bus without reducing service.

The European Electric Bus Statistics Report 2024/25: The Key Takeaways

Why “BESS Everywhere” Isn’t the Answer

Battery energy storage systems (BESS) can buffer depot peaks, but they simply add more imported batteries into the system. For most depots, the first 80% of the benefit comes from software-first measures:

- Charger scheduling aligned with ToD tariffs

- Staggered mid-route top-ups

- Demand response with discoms

These are fast, capital-light interventions that deploy in months, not years. BESS should be used surgically to solve residual problems once scheduling and modest grid upgrades have done their part.

Digital Twins: Planning Before Procurement

The fastest path to resilient electrification is to simulate the system before spending. Tools like EVopt from Microgrid Labs build operational digital twins that combine routes, blocks, dwell times, depot constraints, tariffs, and grid limits.

This co-optimization allows agencies to:

- Justify smaller battery packs

- Identify high-leverage opportunity charging sites

- Align charging schedules with grid and tariff realities

BMTC/KSRTC have already used this approach to plan depot and route deployments, proving the value of “software before steel.”

Study: The Urgent Need for Renewable Energy-Powered Electric Buses in India

A Playbook for India’s Operators and Cities

- Adopt a systems approach: view electric buses not as standalone vehicles or chargers, but as an integrated system of routes, batteries, chargers, and grid.

- Right-size batteries and chargers: base sizing on block-level modeling, not worst-case assumptions.

- Adopt distributed charging: pair depot charging with well-placed terminals for opportunity top-ups.

- Schedule charging like service: dispatch chargers against ToD tariffs and avoid synchronized spikes.

- Engage discoms early: share modeled load shapes to co-plan feeders and managed charging pilots.

- Use BESS sparingly: size only for the problems left unsolved by scheduling and software.

- Localize progressively: support domestic cell production, while hedging imports now through smaller onboard packs.

The Bigger Picture: Energy Security by Design

Electrified buses are more than a transport upgrade. They are a triple dividend: cleaner air, quieter cities, and lower lifecycle costs. But they also sit at the nexus of industrial policy and geopolitics.

India’s advantage lies in its software DNA. By leading with digital-twin planning, distributed opportunity charging, and managed load integration with discoms, India can:

- Reduce demand for imported battery kWh

- Stretch scarce grid capacity further

- Reduce CAPEX and improve ROI

- Deliver reliable, high-frequency public transport

This is not just good engineering – it is strategic autonomy. Smaller batteries, Smarter charging, and software-based system-level optimization are India’s fastest path to electrification at scale, without capital lock-in or import dependency.

Catch the latest Bus Industry updates, Exclusive Interviews, Bus News, and International Bus News on Coach Builders India. Download the latest issue of the The Bus Insider magazine for more insights.