Ashok Leyland Q4 Results: Record-Breaking Profit Surge, Y25 PAT Jumps 26%

Ashok Leyland Q4 results for FY25 highlight a record-breaking quarter with a 38.4% profit surge, strong EBITDA margins, and a 1:1 bonus share issue.

Ashok Leyland, the flagship commercial vehicle manufacturer of the Hinduja Group, has posted its strongest-ever financial results in the fourth quarter and full fiscal year ending March 2025.

The Ashok Leyland Q4 results showcase record-high revenue, EBITDA, and net profits, underscoring the company’s operational excellence and strategic focus across segments.

In a move welcomed by investors, the Board has also approved a 1:1 bonus share issue, rewarding shareholders amid this standout performance.

Financial Highlights: Q4 and FY25

Ashok Leyland closed Q4 FY25 with an EBITDA margin of 15%, representing a significant improvement from 14.1% in Q4 FY24. Net profit (PAT) for the quarter surged by 38.4%, reaching ₹1,246 crore.

Operating profit before tax rose to ₹1,671 crore, reflecting a healthy growth of 13.6%. Cash generation for the quarter stood at a strong ₹3,284 crore.

The full-year FY25 numbers also point to a robust performance, particularly in profitability and cash flow. Net cash for the year came in at ₹4,242 crore, a sharp turnaround from net debt of ₹89 crore in FY24.

New Ashok Leyland LCV Dealership at Mirzapur Strengthens Brand’s Presence in Uttar Pradesh

Ashok Leyland FY25 vs FY24 Financial Summary

The Company declared record numbers for the year ended March 31, 2025:

| Metric | FY25 | FY24 | Change |

|---|---|---|---|

| Revenue (₹ Crore) | 38,753 | 38,367 | +1% |

| Operating PBT (₹ Crore) | 4,245 | 3,886 | +9% |

| PAT (₹ Crore) | 3,303 | 2,618 | +26% |

| EBITDA (₹ Crore) | 4,931 (12.7%) | 4,607 (12.0%) | +7% (basis points) |

| Net Cash (₹ Crore) | 4,242 | (89) | Improved |

Volume Performance and Strategic Growth Areas

The company’s commercial vehicle (CV) sales for FY25 touched 195,093 units, nearly equaling its historical high. Of particular note, MHCV buses achieved record volumes of 21,249 units.

Export sales soared to 15,255 units, marking a 29% jump year-over-year. The Power Solutions and Defence verticals also registered impressive gains, contributing to the diversified performance.

AI in the Bus Industry: Transforming Public Transportation for a Safer, Smarter Future

Focus on Future Technologies

Ashok Leyland continues to push forward on alternative propulsion technologies. The electric vehicle division, Switch Mobility, is gaining momentum, while new ventures in LNG and hydrogen-powered vehicles are underway, aligning with its commitment to future-ready solutions.

Shareholder Benefits: Bonus Issue and Dividends

After delivering two interim dividends during FY25—₹2 per share in November 2024 and ₹4.25 in May 2025—the Board has declared these payouts as final, aggregating to ₹6.25 per share or 625% of face value.

Additionally, the Board has approved a 1:1 bonus share issuance, further enhancing shareholder value.

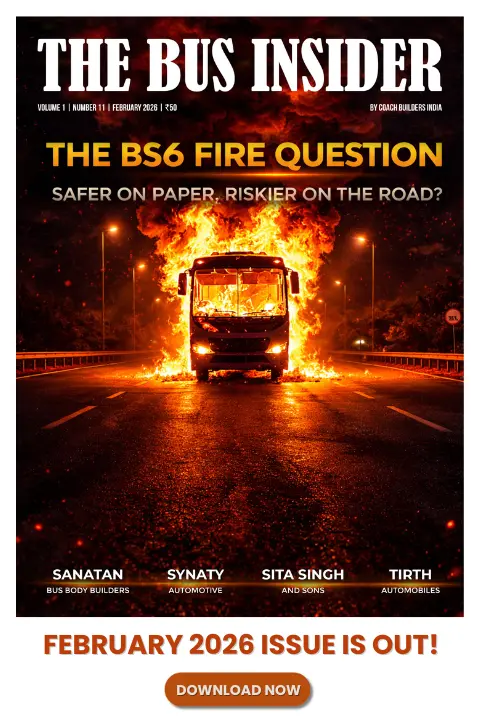

Catch the latest Bus Industry updates, Exclusive Interviews, Bus News, and International Bus News on Coach Builders India. Download the latest issue of the The Bus Insider magazine for more insights.