Indian Bus Industry Market Report | Future Valuation at Rs 104,000 Crore by 2026

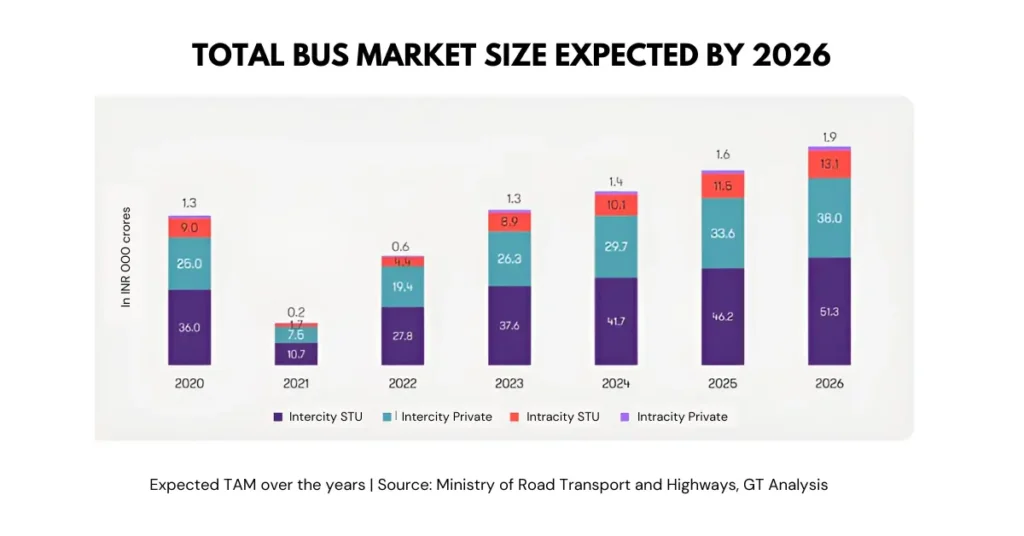

Traveltech 2.0, a new Indian bus industry market report highlights a consistent growth trajectory. The study reveals that the industry is poised to reach a valuation of Rs 104,000 crores by 2026. This growth trajectory is forecasted to maintain a steady compound annual growth rate (CAGR) of 6.64 percent.

The Indian bus industry is undergoing a remarkable surge in growth, reflecting a vibrant landscape of expansion and opportunity.

A new Indian bus industry report unveils promising projections, forecasting substantial value escalation by 2026.

Titled “Traveltech 2.0: The Next Phase of Digitally Empowering the Indian Traveler,” the study delves into market dynamics, digital ticketing transformation, and prospects within the industry.

A collaborative effort between the Internet and Mobile Association of India (IAMAI) and Grant Thornton Bharat, the report further states that the Indian bus industry will reach a value of Rs 104,000 by 2026 and maintain a steady compound annual growth rate (CAGR) of 6.64 percent.

Also Read: RedBus Report 2023 reveals key trends in the Indian bus industry

Market Dynamics of the Indian Bus Industry

The report highlights significant growth trajectories for both State Transport Undertakings (STUs) and private buses, projecting CAGRs of 6.36% and 7.37% respectively.

Notable STU markets of the Indian bus industry encompass the following:

- Karnataka

- Maharashtra

- Tamil Nadu

- Andhra Pradesh

- Telangana

- Uttar Pradesh

These states collectively dominate nearly 70% of the market share in the Indian bus industry.

On the other hand, the top five states in the Total Addressable Market (TAM) are Uttar Pradesh, Maharashtra, Rajasthan, Punjab, and Haryana.

These states are projected to collectively contribute approximately 45% share by 2026.

Also Read: A Comprehensive Overview of Bus Sales in India in 2023

Growth Drivers of The Indian Bus Industry

The surge in growth within the Indian bus industry is partly fueled by the growing adoption of online ticketing, particularly for inter-city services.

Also, there’s considerable interest in value-added services like live bus tracking, particularly among travelers in major cities.

These features are also becoming staples in city buses across India.

A recent survey conducted among bus travelers across eight cities revealed significant interest in the adoption of online ticketing and these additional services.

According to Traveltech 2.0, while online payment adoption is rapidly increasing in the inter-city segment, non-AC buses, and intra-city buses continue to rely on offline transactions.

The “Traveltech 2.0: The Next Phase of Digitally Empowering the Indian Traveler” is a collaborative effort between the Internet and Mobile Association of India (IAMAI) and Grant Thornton Bharat and was inaugurated at the India Digital Summit 2024 in Mumbai.

Earlier in January 2024, a redBus report highlighted the key trends of the Indian bus industry in 2023.

During the initial 9 months of 2023, an astonishing 6 crore bus tickets were booked, underscoring the strong demand for intercity bus travel, the report stated.

Online ticket bookings continued their upward trajectory, gaining significant ground in non-metro and smaller towns in 2023.

Additionally, the redBus report highlighted that Indian passengers collectively undertook an impressive 4.1 crore kilometers of intercity bus travel per day, with an average trip distance of 207 kilometers per individual.

The Future of the Indian Bus Industry

India’s bus industry trajectory indicates not just a substantial economic prospect, but also a transition towards more accessible, streamlined, and technology-driven public transportation solutions.

As the sector advances, the partnership among technology providers, transport operators, and policymakers will be pivotal in unlocking the complete potential of India’s digital travel revolution.

Also Read: Long Weekend Travel Trends by Bus: Abhibus Insights 2024

OTAs will Play A Significant Role

As digital adoption gains momentum, the report indicates that upcoming advancements in travel technology will unleash the complete potential of Online Travel Agencies (OTAs) in the ground transport sector.

Nevertheless, it also emphasizes the necessity for policy adaptations to rectify tax discrepancies between e-commerce platforms and direct bookings, which currently put online operators at a disadvantage.

By creating a fairer competitive landscape, the industry can foster a more balanced growth trajectory that benefits both service providers and travelers.

What Industry Leaders Have to Say

Industry leaders such as Chalo, ixigo, Redbus, and PayTM Travel are optimistic about the transformative role of technology in advancing growth and enhancing the travel experience in India.

They stress the significance of utilizing technology to empower travelers, boost online adoption, and bridge the digital gap in ground transportation.

“Technology is revolutionizing the way we travel, making it easier to use than ever before. I’m confident that it will spark meaningful conversations and shape positive policies that will ensure that we leverage technology in the best possible way to make city bus travel better,” said Dhruv Chopra Co-founder and CMO, Chalo, speaking at the launching of the report at the India Digital Summit 2024 on February 28.

“With infrastructure development, increased internet penetration, modernization, and improvement in service quality with OTA-driven tech upgrades, the passenger mobility in India segment is poised for further growth. By leveraging technology, OTAs are empowering travelers to make smarter travel decisions, and are playing a leading role in driving online adoption in the ground travel sector,” says Aloke Bajpai, Chairman, Managing Director and Group CEO, ixigo.

Additionally, stakeholders advocate for policy reforms to tackle tax inequalities between e-commerce operators and suppliers in the domestic market.

This entails revisiting GST charges for bookings made via e-commerce platforms versus direct bookings from bus operators, irrespective of the booking method.

“The IAMAI Travel Tech report highlights the imminent evolution of travel technology as we tap into the complete capabilities of OTAs within the ground transport sector,” stated Prakash Sangam, CEO of redBus.

“Addressing tax discrepancies between e-commerce operators and suppliers in the domestic market is crucial. Presently, customers face a 5% GST charge when booking a non-AC bus through an e-commerce platform, whereas this charge is waived for direct bookings from bus operators, regardless of whether it’s conducted online or offline,” he adds.

Catch the Latest Bus Industry Updates, Exclusive Interviews, Bus News, and International Bus News on Coach Builders India. Download the latest issue of the The Bus Insider magazine for industry insights.